Payroll software is a low-priced, automated, often turnkey management solution for everything from employee payments to human resources, benefits and taxes.

Scalable platforms like Gusto and QuickBooks are ideal for small and midsize businesses that don’t necessarily have the fiscal wherewithal to onboard an entire HR department but need flexibility when it comes to handling all things HR. Nothing against carbon-based AI (people), but these frameworks are great for avoiding a major pain point: human error.

SEE: Best payroll software for your small business in 2022 (TechRepublic)

Two of the top software-as-a-service payroll options are Gusto and Intuit’s QuickBooks Online Payroll — both flexible, scalable and based on a subscription model with several pricing tiers. Gusto is ideal for small companies looking for ease of use and versatility, and QuickBooks Online Payroll is good for small and midsize firms that already use QuickBooks Online for bookkeeping and accounting.

Jump to:

- Gusto vs. QuickBooks Payroll: Feature comparison table

- Gusto vs. QuickBooks Payroll pricing

- Gusto’s key features

- QuickBooks Online Payroll’s key features

- Gusto’s pros and cons

- QuickBooks Payroll’s pros and cons

- How we evaluated Gusto and QuickBooks Online Payroll

- Should your business use Gusto or QuickBooks Online Payroll?

Gusto vs. QuickBooks Payroll: Feature comparison table

| Features | Gusto | QuickBooks Online Payroll |

|---|---|---|

| Submits state, federal and local taxes | Yes | Yes |

| Built-in expense tracking | No | Yes |

| Mobile payroll app | No | No |

| Free trial period | No | 30-day free trial or 50% off for three months |

| Global payroll | For contractors only | No |

| Employee benefits administration | Yes | Yes |

| Starting price per month | $40 + $6 per employee | $45 + $4 per employee |

Gusto vs. QuickBooks Payroll pricing

The price of entry is relatively low for both Gusto and QuickBooks Payroll, but add-ons add up.

Gusto’s pricing

Gusto has three payroll plans:

- Gusto Simple costs $40 per month and an additional $6 per month for every employee enrolled in the software. It includes unlimited payroll runs, employee self-service and health benefits administration.

- Gusto Plus costs $80 per month and an additional $12 per month for every employee. It adds features like multi-state payroll, custom onboarding templates, time tracking, next-day direct deposit and PTO management.

- Gusto Premium has custom pricing only, available on request. It’s intended for large businesses and corporations and adds HR resource library access, compliance alert and account setup.

Like its competitor Square Payroll, Gusto also has a plan specific to employers who only pay contractors: Employers pay $6 per month for each contractor paid for the first six months. After six months, your cost is $35 per month plus the monthly $6 per employee fee.

Gusto doesn’t advertise a free trial, though it does have a demo on its site. Optional add-ons include priority support ($8 per person per month), international contractor payments and state tax filing.

For a more in-depth analysis of Gusto and its features and pricing, read through our complete Gusto review.

QuickBooks Payroll’s pricing

QuickBooks Online Payroll also has three payroll plans with lower per-employee fees compared to Gusto:

- QuickBooks Payroll Core costs $45 per month and $5 for every employee paid. It includes full-service payroll basics, automatic payroll runs and next-day direct deposit.

- QuickBooks Payroll Premium costs $75 per month and $8 for every employee paid. It adds same-day direct deposit, mobile time tracking and 24/7 support.

- QuickBooks Payroll Elite costs $125 per month and $10 for every employee paid. It includes expert setup, project tracking and an extra layer of tax-penalty protection.

With both QuickBooks Online and QuickBooks Online Payroll, new customers can choose to get 50% off the software’s base price for three months or to sign up for a 30-day free trial.

For more information on QuickBooks Online Payroll’s pricing, plans and features, read our QuickBooks Payroll review.

Gusto’s key features

Full-service payroll

Gusto’s payroll management software is great for businesses with 10-20 employees. It automates a range of payroll functions, from easy to complex, both for employees and contractors (Figure A). The framework also handles a plethora of HR tasks, including budget-based disability insurance coverage and employee benefits like health, dental and vision insurance.

Figure A

Gusto also automatically files taxes and end-of-year tax forms and expedites time tracking, expense tracking, scheduling shifts and employee onboarding. Importantly, no domain experts are required. Because of ease of use and setup, it’s ideal for companies with no or new payroll managers.

Gusto’s employee payroll services and benefits administration extends to domestic employees of U.S. companies only. However, businesses with international contractors can enroll in Gusto’s global contractor plan to pay contractors in over one hundred countries.

Employee benefits

Gusto offers built-in benefits administration that sifts through thousands of group health insurance plans — 9,000 plans offered by 30 carriers — based on a business’s size, location, budget and other parameters. It also integrates payroll deductions for medical, dental and vision insurance. Since Gusto uses an in-house brokerage, Gusto doesn’t charge a fee to integrate benefits with payroll software. Companies pay the insurance premium only.

Gusto also brokers workers’ compensation insurance, which can be integrated with its payroll software for accurate payroll premium deductions.

Third-party integration

Gusto is one of the more popular small and midsize business payroll providers, so it syncs with dozens of third-party apps for accounting, bookkeeping, time tracking and project management. Gusto even syncs with QuickBooks Online — so if you already use QuickBooks Online but don’t love Intuit’s payroll solution, Gusto is still an option.

QuickBooks’ key features

Full-service payroll

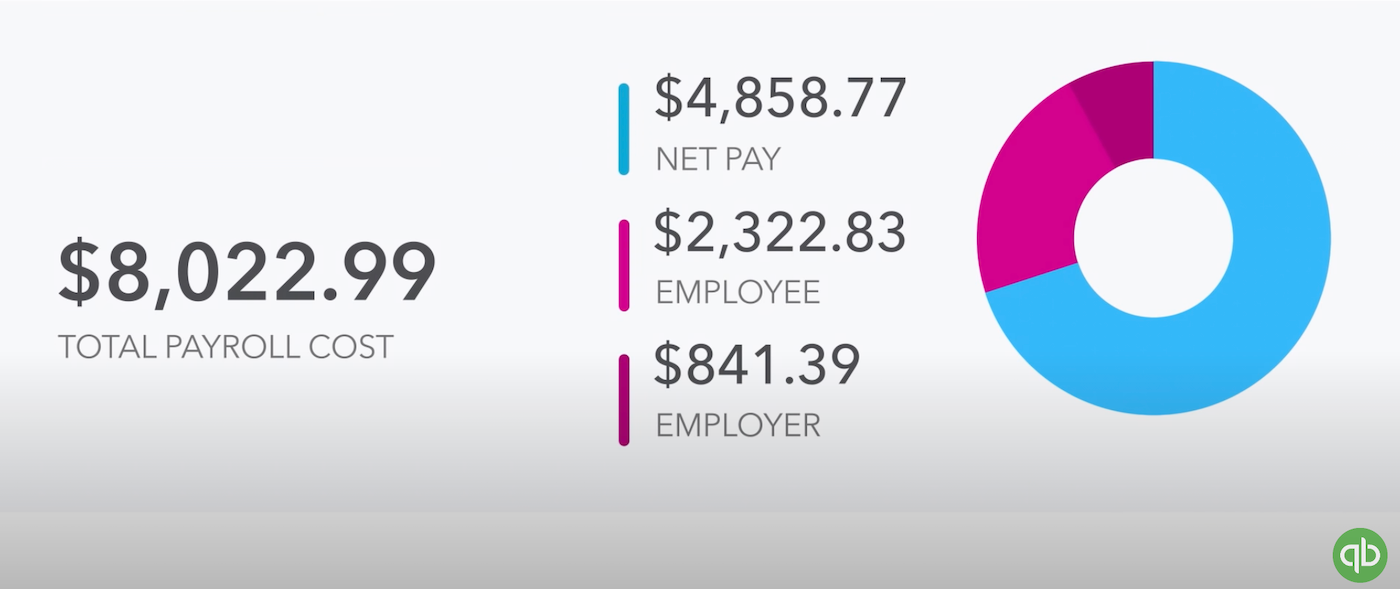

Like Gusto, QuickBooks Online Payroll offers full-service payroll tools businesses can use to pay their employees, make payroll tax and other deductions, manage workers’ compensation insurance and generate payroll reports (Figure B).

Figure B

QuickBooks Online Payroll’s full-service payroll software handles domestic payroll only, though you could pay international contractors with U.S. bank accounts. However, you can’t use QuickBooks Payroll to deposit money in foreign bank accounts.

SEE: The best QuickBooks Payroll alternatives for 2023 (TechRepublic)

Employee benefits

QuickBooks Payroll partners with online broker SimplyInsured, which offers medical, dental and vision insurance from major carriers based on HR parameters and lets HR managers create a comprehensive coverage plan, complete an application, add employees and upload documents. It also helps review and approve employee eligibility for a chosen plan.

Additionally, the QuickBooks framework calculates health, medical and vision, and it adds them directly into the company’s payroll software. QuickBooks also partners with Guideline to provide 401(k) plans.

Since QuickBooks partners with a third party to provide employee benefits, you’ll typically pay an additional fee on top of the premium to integrate your employee benefits with QuickBooks Payroll.

Third-party integration

QuickBooks Online Payroll’s biggest draw is how naturally it syncs with QuickBooks Online. Integrating the two products ensures your general ledger updates automatically and in real time. Both programs create insightful financial reports and integrate with hundreds of third-party business applications that small businesses can use to manage employees with or without a dedicated, in-house HR or accounting team.

SEE: What is Software as a Service? (TechRepublic)

Gusto’s pros and cons

Pros

- Unlimited monthly payroll runs.

- International contractor payments (additional fee).

- No additional fee for employee benefits integration and administration.

- Benefits options include health insurance, commuter benefits, 401(k)s, FSAs and HSAs.

- Basic onboarding tools with every plan.

- Direct deposit and on-demand payment option through Gusto Wallet.

Cons

- High per-employee fee.

- Health insurance coverage limited to 37 states.

- No mobile app for employers.

- Extremely limited HR features, including HR library access and HR expert support.

- No compliance alerts with two cheapest plans.

QuickBooks Online Payroll’s pros and cons

Pros

- Low per-employee fee.

- Seamless integration with QuickBooks Online and many third-party apps.

- User-friendly interface.

- Multiple plan options for easy scalability.

- Next-day or same-day payroll, depending on the plan.

Cons

- No mobile app for employers.

- No workers’ compensation insurance integration with cheapest plan.

- Limited time-tracking integration with cheapest plan.

- No international payroll option.

How we evaluated Gusto and QuickBooks Payroll

To rank, evaluate and compare Gusto with QuickBooks Payroll, we viewed demos on both companies’ websites. We signed up for QuickBooks Payroll’s free trial and toured the software virtually. We also considered aggregate ratings and individual reviews from various app stores and consumer review sites like the Better Business Bureau and Gartner Peer Insights.

Should your business use Gusto or QuickBooks Online Payroll?

Gusto payroll is perfectly suited for small and midmarket businesses with fewer than 50 employees, though companies with more employees can still benefit from Gusto’s thorough payroll automation. While Gusto doesn’t have many HR tools with its two cheapest plans, its insurance brokerage and built-in benefits administration keeps costs lower for businesses and helps employers find competitive benefits to retain top employees.

QuickBooks Payroll can also work for small and midsize businesses, especially those that want to save money by taking advantage of QuickBooks’ relatively low per-employee fee. Its higher-tier plans have slightly more HR features than Gusto’s, and even though both products sync with QuickBooks Online, QuickBooks Payroll’s interface has a lower learning curve for customers already familiar with the Intuit suite of products.