Square Payroll and OnPay are two popular payroll software solutions designed to streamline payroll processing and improve efficiency for businesses. Square Payroll is known for its user-friendly interface and seamless integration with other Square products, catering primarily to small businesses. OnPay, on the other hand, offers a comprehensive payroll and HR solution suitable for a wide range of businesses, with a strong focus on compliance and flexibility.

Jump to:

- Square Payroll vs OnPay: Comparison table

- Square Payroll and OnPay pricing

- Feature comparison: Square Payroll vs OnPay

- Square Payroll pros and cons

- OnPay pros and cons

- Methodology

- Should your organization use Square Payroll or OnPay?

Square Payroll vs. OnPay: Comparison table

| Features | Square Payroll | OnPay |

|---|---|---|

| Payroll processing | Yes | Yes |

| Tax filing and payment | Yes | Yes |

| Employee self-service | Yes | Yes |

| HR features | Limited | Yes |

| Built-in benefits administration | No | Yes |

| Built-in time tracking | Yes | No |

| Pricing per month | $35 base fee + $5/employee | $40 base fee + $6/employee |

Featured Partners

Square Payroll and OnPay pricing

Square Payroll pricing is straightforward and designed to cater to small businesses. It charges a $35 base fee per month and an additional $5 per employee per month. This pricing structure is simple and easy to understand, allowing businesses to budget and plan their payroll expenses efficiently.

SEE: Looking for an alternative to OnPay? Here’s a comparison of the top OnPay competitors and alternatives.

OnPay, on the other hand, is priced slightly higher. It charges a $40 base fee per month and $6 per employee per month. This structure is still transparent and affordable for many businesses. Nonetheless, it’s essential to assess whether there are additional costs for extra features like benefits administration, HR tools or integrations with third-party software.

Businesses should also keep a keen eye out for potential hidden costs, such as implementation fees. However, both products promise to include everything you may need in these plans without hidden charges or sneaky fees.

To analyze each product’s pricing structure and features in greater detail, check out our Square Payroll and OnPay product reviews.

Feature comparison: Square Payroll vs. OnPay

Payroll processing

Both Square Payroll and OnPay provide efficient payroll processing capabilities, ensuring accurate and timely payments for employees. They offer features such as multiple payment options, automatic tax calculations and direct deposit. While both solutions excel in payroll processing, Square Payroll is recognized for its user-friendly interface (Figure A), making it especially suitable for small businesses. OnPay, in contrast, offers a more comprehensive solution that can cater to the needs of businesses of various sizes.

Figure A

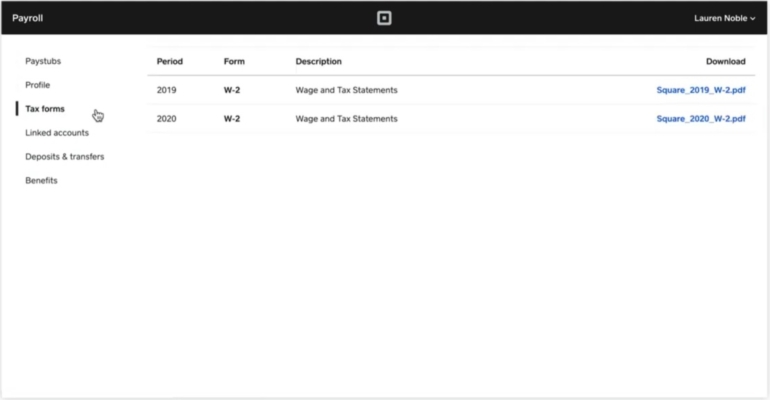

Tax filing and payment

Square Payroll and OnPay handle tax filing (Figure B) and payment for your business, simplifying the process and helping you stay compliant with tax regulations. They automatically calculate, withhold and remit federal and state payroll taxes, reducing the risk of errors and penalties. OnPay stands out for its tax filing guarantee, offering to cover any penalties or fines incurred due to mistakes made by its software.

Figure B

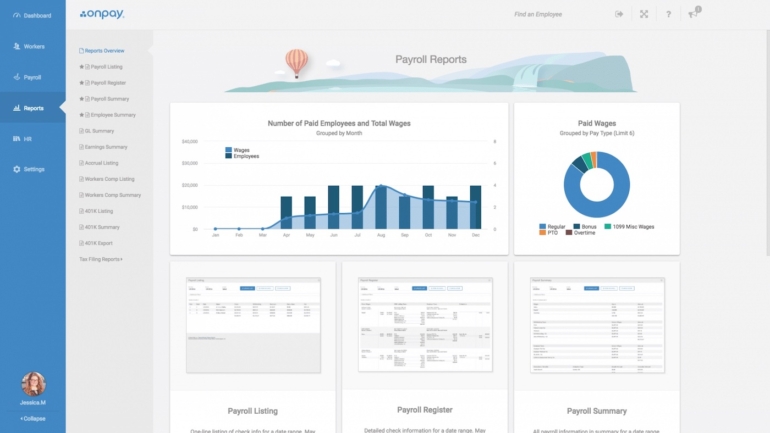

Employee self-service

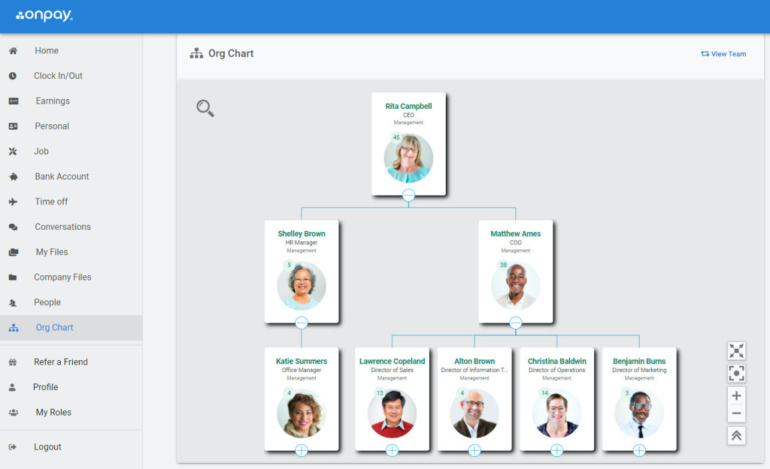

Both Square Payroll and OnPay offer employee self-service portals (Figure C), enabling employees to access pay stubs, update personal information and manage their withholdings. These portals help reduce the workload of HR staff by empowering employees to manage their own information, leading to more accurate records and a smoother payroll process.

Figure C

HR features

OnPay provides a wider range of HR features compared to Square Payroll. OnPay’s HR suite includes onboarding, performance management, PTO tracking and document storage. Square Payroll, on the other hand, offers limited HR functionality, primarily focusing on payroll processing. Businesses that require comprehensive HR management capabilities may find OnPay more suitable, while those looking for a simple payroll solution can consider Square Payroll.

SEE: Discover the best alternative to Square Payroll for 2023.

Benefits administration

OnPay offers robust benefits administration features, allowing businesses to manage health insurance, retirement plans and other employee benefits. Square Payroll does not provide built-in benefits administration, which could be a drawback for businesses requiring this functionality. Companies that need comprehensive benefits management options should consider OnPay, while those focusing solely on payroll processing might find Square Payroll sufficient.

Time tracking

Square Payroll and OnPay both include time tracking features, allowing businesses to accurately track employee hours and ensure precise payroll calculations. Square Payroll integrates with Square’s point-of-sale system and time tracking apps, while OnPay provides a built-in time clock and supports integration with popular time tracking tools. However, OnPay has no built-in time tracking features. Both solutions help improve productivity and reduce payroll errors by maintaining accurate timekeeping records.

Square Payroll pros and cons

Pros of Square Payroll

- User-friendly interface simplifies payroll processing, making it particularly suitable for small businesses and first-time users.

- Seamless integration with Square’s point-of-sale system and time tracking apps ensures a cohesive workflow across various functions.

- Transparent pricing structure with a flat monthly fee and per-employee cost, allowing businesses to easily understand and plan their expenses.

Cons of Square Payroll

- Limited HR features within the core offering may not fully cater to businesses with more comprehensive HR management requirements.

- Lack of built-in benefits administration could be a drawback for businesses needing to manage employee benefits as part of their payroll solution.

OnPay pros and cons

Pros of OnPay

- Comprehensive payroll and HR features accommodate a wide range of business needs, providing an all-in-one solution for managing your workforce.

- Robust benefits administration capabilities allow businesses to customize their offerings to attract and retain top talent.

- Tax filing guarantee offers to cover any penalties or fines incurred due to mistakes made by OnPay’s software, ensuring peace of mind for businesses.

Cons of OnPay

- More complex interface and feature set may require a steeper learning curve compared to simpler payroll solutions like Square Payroll.

- Pricing structure, with a base fee and per-employee cost, could become more expensive as your business grows, especially when compared to flat-fee pricing models.

Methodology

To deliver a reliable comparison, we analyzed the features, pricing, pros and cons of Square Payroll and OnPay by reviewing customer feedback and product specifications from official documentation.

Should your organization use Square Payroll or OnPay?

The decision between Square Payroll and OnPay depends on your organization’s specific needs, priorities and the level of comprehensiveness you require in a payroll solution. Square Payroll is ideal for small businesses seeking simplicity and seamless integration with Square’s point-of-sale system. OnPay suits businesses requiring a comprehensive payroll and HR solution with robust benefits administration.

When choosing the right payroll software for your organization, carefully consider factors such as the comprehensiveness of the features, integration capabilities, pricing structure and overall ease of use.